Insights

Asymmetrica’s risks management

At Asymmetrica investments we use financial risk modeling as a formal econometric technique to determine the aggregate risk of portfolios composed of real assets.

We use the so-called Capital Asset Pricing Model (CAPM) to describe the relationship between systematic risk and expected return for assets. CAPM is widely used throughout finance for pricing risky securities and generating expected returns for assets given the risk of those assets and the cost of capital.

Based on the concept of time value of money (TVM), we develop models for natural resources portfolios.

Our modeling approach uses a variety of techniques including market risk, value at risk (VaR), historical simulation (HS), or extreme value theory (EVT) in order to analyze a portfolio and make forecasts of the likely losses that would be incurred for a variety of risks.

Such risks are typically grouped into market risk, model risk, liquidity risk, and operational risk categories.

Our models are implemented in Python and Javascript, and fed with market prices in order to be able to derive an estimation of our model parameters.

What is the rationale behind investing in Avocados?

Avocado orchards provide high risk adjusted returns and an uncorrelated source of income. Avocado investment returns are generated through two components: income and capital appreciation. The sale of avocados provides a double-digit uncorrelated source of income, while the underlying land prices provide a robust downside protection.

Investments in avocado orchards resemble other real asset investments such as infrastructure and natural resources with high barriers to enter the market and inflation hedging properties.

Avocado investments in contrast to other agricultural investments have high margins, the average EBITDA margin of an avocado plantation is about 70%. This is higher than the EBITDA margin of the five largest companies in the S&P500 (AMZN 12%, GOOG 25%, AAPL 30%, MSFT 46%, FB 50%).

Margins of avocado orchards are protected by high barriers to enter the market. It takes four years until a farm gets its first crop and 15 year until it reaches its maximum production. Moreover, there is a limited supply, as there is scarcity for fertile places where avocados can grow. While the demand for avocados is growing, supply for avocados cannot increase at the same rate, which results in increasing prices.

The income derived from investments in avocado orchards has been resilient during the current COVID 19 crisis, as the sale from avocados has been less fragile to disruptions in supply chains. Moreover, it is likely that the income derived from avocado orchards will continue to be resilient during the current and future potential outbreaks, as governments view food security as a priority.

Investments Highlights

Downside protection

Avocado investments provide a compelling risk return profile. The downside risk, i.e. the risk of a permanent loss of capital

is limited by the land and the avocado trees. Avocados are permanent crops which are more tolerant to extreme weather conditions than raw crops. Moreover, consumer staples is a defensive sector, that is less sensitive to recessions.

Asymmetric upside

The limited supply and growing demand for avocados, creates scarcity and increases prices. The high margins and price spikes in avocados provide unlevered IRR in the ranges of 20-30%.

Capital preservation in real terms

Preservation of capital is paramount to investing. Real assets like avocado orchards remain productive in perpetuity and provide an inflation hedge. Investments in natural resources have exhibited equity-like returns, positive correlations with commodity prices, and outperformance during periods of high inflation.

Diversifying source of return

In terms of investing, there is nothing like free lunch. With avocado orchards, a true diversification from systematic risks is provided. The naive geographical diversification however is not effective when needed the most i.e. when volatility rises and correlations increase. Avocados are price inelastic products, consequently they are a stable source of income during recessions. Avocados like farmland in general exhibits low return correlation with other asset classes.

Superior Cash-flows

Cash flows from avocado orchards result from the sale of avocados. Cash flows provide an additional layer of downside protection and are a relatively more stable way of determining expected returns.

Impact investing: how does Switzerland stay at the top?

It all begins with an idea.

It is estimated that the private impact investing market comprises 33 billion dollars in fund money worldwide - a third of which is managed in Switzerland. A recent article for the Plattform für Wirtschaftspolitik highlighted how the Swiss Impact investing ecosystem can rely on unique strengths and favorable external conditions. Nevertheless, impact investing remains a niche compared to the overall market and more collaboration between the public and private sectors are necessary.

At Asymmetrica Investing we make partnerships and impact ventures a priority and we are keen to collaborate with all the actors to deliver impact investing.

Read the original article here.

Portfolio diversification during the COVID 19 crisis: Preventing income shortfalls with avocado orchards

It all begins with an idea.

The disconnect between capital markets, the real economy and divided distributions

There is a strong disconnect between the real economy, the dividend distributions of companies and the prices of major indexes. On the one hand, the economy is contracting[1] jobs are getting lost[2] and companies are cutting back on distributions[3]. On the other hand, the S&P 500 is trading at around the levels as it was in mid-2019, i.e. -10.3% return YTD[4]. The disconnect has three main reasons:

First, most job losses are related to retail, leisure and hospitality industries. They form part of the consumer discretionary sector, which is only about 10% of the index. While 50% of the market capitalization of the S&P 500 forecasts show no significant deterioration in their EPS for 2020[5].

Second, the reduction in interest rates has resulted in an expansion of multiples. Consequently, equity prices have risen as the lower discount rate has impacted the terminal value of each individual company[6].

Third, the Fed’s balance sheet is expected to grow by a total of $7 trillion in 2020[7]. This is about a third of the US GDP[8] and about 29% of the S&P 500 market capitalization[9].

However, the S&P 500 trading at around the levels as it was in mid-2019 does not mean that companies will be able to pay the same level of dividends as they did in 2019. Dividend futures project disruption in dividend payments between now and 2028. If history serves as a guide, we can expect the income shortfall to be close to the one of the 2008 Financial Crisis, where dividends fell by about a quarter and took about four years to recover (Forbes 2020)

For investors seeking equity-like returns with reliable sources of income, it is important to assess how well their portfolios are positioned to withstand the impact of dividend reductions over the next three to four years.

Avocados have been a robust source of income during the COVID 19 crisis

One alternative source of income with inflation hedging properties are real assets[10], specifically natural resources[11]. Investments in natural resources have exhibited equity-like returns, positive correlations with commodity prices, and outperformance during periods of high inflation (Toczylowski, A. 2018).

Agriculture as a subset of natural resources has been a resilient sector during the COVID 19 crisis, as income from these companies has been less fragile to disruptions in supply chains. Moreover, it is likely that this sector will continue to be resilient during the current and future potential outbreaks, as governments view food security as a priority.

The problem with agricultural companies is that they generally have thin margins. This is mainly because of the highly competitive environment. Avocado orchards, in contrast, have high margins, the average EBITDA margin of an avocado plantation is about 70%. This is higher than the EBITDA margin of the five largest companies in the S&P500 (AMZN 12%, GOOG 25%, AAPL 30%, MSFT 46%, FB 50%)[12].

Why are avocado orchards so profitable? Margins of avocado orchards are protected by high barriers to enter the market. It takes four years until a farm gets its first crop and 15 years[13] until it reaches its maximum production. Moreover, there is a limited supply, as there is scarcity for fertile places where avocados can grow. While the demand for avocados is growing, the supply for avocados cannot increase at the same rate, which results in increasing prices.

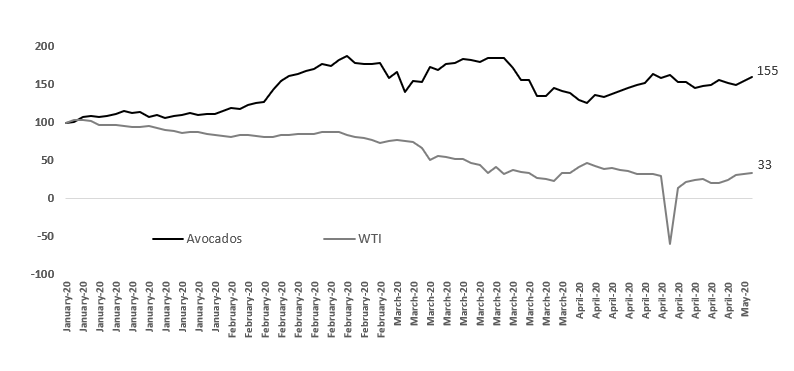

Moreover, in contrast to other commodities, avocado prices and the income from avocado orchards have been resilient during the COVID 19 crisis. The chart below compares WTI spot prices vs. avocado farmgate prices[14].

Avocados vs. WTI during the COVID 19 crisis

In conclusion, avocado orchards provide a true diversification from systematic risks. The naive geographical diversification however is not effective when needed the most i.e. when volatility rises, and correlations increase. Avocados are price inelastic products, consequently they are a stable source of income during recessions.

[1] April’s figure for the global manufacturing PMI (39.8) shows a contraction

[2] April’s jobs report in the US shows the unemployment rate at 14.7%

[3] Delta Air Lines Inc., Ford Motor Co., Macy’s Inc., announced dividend suspensions in the second quarter. US banks, usually big dividend payers are likely to follow the path of British banks and slash dividends.

[4] 12.05.2020

[5] IT (25.7%), HC (15.4%) Consumer Staples (7.4%), Utilities (3.3%) make about 50% of the SP 500 market capitalization and these sectors have been more resilient to the current crisis

[6] Terminal values often make about 60% of the value of a stock when using DCF method to value a company

[7] An increase YTD of $ 2.5 trillion and an additional balance sheet expansion of $ 4.5 trillion based on announced monetary policy interventions

[8] US GDP 2019 $21.428 trillion

[9] As of the 8th May 2020 S&P500 Market Capitalization $24.3 trillion, Willshire 5000 $29.1 trillion, Total Ex Foreign Issues $45.4 trillion and Equities total Issues in the U.S. $54.9 trillion (Yardeni 2020)

[10] Over time the general understanding of real assets has shifted from any inflation hedging asset i.e. assets that tend to increase in nominal value with unexpected inflation (Froot K. 1978) to a narrower definition comprising tangible assets with intrinsic value. (Donohue et al., M.2009; pp.119). Today we understand real assets. as alternative investments such as real estate, infrastructure, and natural resources (Mcvey. H. et al., 2017)

[11] As of December 2019, natural resources assets under management (AUM) surpassed $760bn (Preqin 2020)

[12] As of May 2020, the top 5 largest companies by market capitalization are close to 20% of the S&P500 total market cap

[13] With new technologies it is possible to reach maximal production after 8 to 10 years

[14] Avocado farmgate prices describe the price of export quality avocados if they were purchased directly from a farm in Mexico, without any additional markup

New Orchards for sustainable avocados

It all begins with an idea.

Agriculture is a major source of greenhouse gas emissions, as it releases large quantities of carbon dioxide through the burning of biomass. Some significant changes can be done just by producing fruits and vegetables in places with the right pedoclimatic conditions.

Asymmetrica is leading the way with avocados. The problem with avocados starts when producers cultivate avocados in nonsensical places, i.e. when the irrigation process is not based on rainwater or natural moisture in the soil.

Our orchards are located throughout the state of Mexico. Asymmetrica is looking at productive lands in new states for avocado like Nayarit and Jalisco, which qualify for their sustainable climate characteristics.