Insights

What is the rationale behind investing in Avocados?

Avocado orchards provide high risk adjusted returns and an uncorrelated source of income. Avocado investment returns are generated through two components: income and capital appreciation. The sale of avocados provides a double-digit uncorrelated source of income, while the underlying land prices provide a robust downside protection.

Investments in avocado orchards resemble other real asset investments such as infrastructure and natural resources with high barriers to enter the market and inflation hedging properties.

Avocado investments in contrast to other agricultural investments have high margins, the average EBITDA margin of an avocado plantation is about 70%. This is higher than the EBITDA margin of the five largest companies in the S&P500 (AMZN 12%, GOOG 25%, AAPL 30%, MSFT 46%, FB 50%).

Margins of avocado orchards are protected by high barriers to enter the market. It takes four years until a farm gets its first crop and 15 year until it reaches its maximum production. Moreover, there is a limited supply, as there is scarcity for fertile places where avocados can grow. While the demand for avocados is growing, supply for avocados cannot increase at the same rate, which results in increasing prices.

The income derived from investments in avocado orchards has been resilient during the current COVID 19 crisis, as the sale from avocados has been less fragile to disruptions in supply chains. Moreover, it is likely that the income derived from avocado orchards will continue to be resilient during the current and future potential outbreaks, as governments view food security as a priority.

Investments Highlights

Downside protection

Avocado investments provide a compelling risk return profile. The downside risk, i.e. the risk of a permanent loss of capital

is limited by the land and the avocado trees. Avocados are permanent crops which are more tolerant to extreme weather conditions than raw crops. Moreover, consumer staples is a defensive sector, that is less sensitive to recessions.

Asymmetric upside

The limited supply and growing demand for avocados, creates scarcity and increases prices. The high margins and price spikes in avocados provide unlevered IRR in the ranges of 20-30%.

Capital preservation in real terms

Preservation of capital is paramount to investing. Real assets like avocado orchards remain productive in perpetuity and provide an inflation hedge. Investments in natural resources have exhibited equity-like returns, positive correlations with commodity prices, and outperformance during periods of high inflation.

Diversifying source of return

In terms of investing, there is nothing like free lunch. With avocado orchards, a true diversification from systematic risks is provided. The naive geographical diversification however is not effective when needed the most i.e. when volatility rises and correlations increase. Avocados are price inelastic products, consequently they are a stable source of income during recessions. Avocados like farmland in general exhibits low return correlation with other asset classes.

Superior Cash-flows

Cash flows from avocado orchards result from the sale of avocados. Cash flows provide an additional layer of downside protection and are a relatively more stable way of determining expected returns.

Impact investing: how does Switzerland stay at the top?

It all begins with an idea.

It is estimated that the private impact investing market comprises 33 billion dollars in fund money worldwide - a third of which is managed in Switzerland. A recent article for the Plattform für Wirtschaftspolitik highlighted how the Swiss Impact investing ecosystem can rely on unique strengths and favorable external conditions. Nevertheless, impact investing remains a niche compared to the overall market and more collaboration between the public and private sectors are necessary.

At Asymmetrica Investing we make partnerships and impact ventures a priority and we are keen to collaborate with all the actors to deliver impact investing.

Read the original article here.

Portfolio diversification during the COVID 19 crisis: Preventing income shortfalls with avocado orchards

It all begins with an idea.

The disconnect between capital markets, the real economy and divided distributions

There is a strong disconnect between the real economy, the dividend distributions of companies and the prices of major indexes. On the one hand, the economy is contracting[1] jobs are getting lost[2] and companies are cutting back on distributions[3]. On the other hand, the S&P 500 is trading at around the levels as it was in mid-2019, i.e. -10.3% return YTD[4]. The disconnect has three main reasons:

First, most job losses are related to retail, leisure and hospitality industries. They form part of the consumer discretionary sector, which is only about 10% of the index. While 50% of the market capitalization of the S&P 500 forecasts show no significant deterioration in their EPS for 2020[5].

Second, the reduction in interest rates has resulted in an expansion of multiples. Consequently, equity prices have risen as the lower discount rate has impacted the terminal value of each individual company[6].

Third, the Fed’s balance sheet is expected to grow by a total of $7 trillion in 2020[7]. This is about a third of the US GDP[8] and about 29% of the S&P 500 market capitalization[9].

However, the S&P 500 trading at around the levels as it was in mid-2019 does not mean that companies will be able to pay the same level of dividends as they did in 2019. Dividend futures project disruption in dividend payments between now and 2028. If history serves as a guide, we can expect the income shortfall to be close to the one of the 2008 Financial Crisis, where dividends fell by about a quarter and took about four years to recover (Forbes 2020)

For investors seeking equity-like returns with reliable sources of income, it is important to assess how well their portfolios are positioned to withstand the impact of dividend reductions over the next three to four years.

Avocados have been a robust source of income during the COVID 19 crisis

One alternative source of income with inflation hedging properties are real assets[10], specifically natural resources[11]. Investments in natural resources have exhibited equity-like returns, positive correlations with commodity prices, and outperformance during periods of high inflation (Toczylowski, A. 2018).

Agriculture as a subset of natural resources has been a resilient sector during the COVID 19 crisis, as income from these companies has been less fragile to disruptions in supply chains. Moreover, it is likely that this sector will continue to be resilient during the current and future potential outbreaks, as governments view food security as a priority.

The problem with agricultural companies is that they generally have thin margins. This is mainly because of the highly competitive environment. Avocado orchards, in contrast, have high margins, the average EBITDA margin of an avocado plantation is about 70%. This is higher than the EBITDA margin of the five largest companies in the S&P500 (AMZN 12%, GOOG 25%, AAPL 30%, MSFT 46%, FB 50%)[12].

Why are avocado orchards so profitable? Margins of avocado orchards are protected by high barriers to enter the market. It takes four years until a farm gets its first crop and 15 years[13] until it reaches its maximum production. Moreover, there is a limited supply, as there is scarcity for fertile places where avocados can grow. While the demand for avocados is growing, the supply for avocados cannot increase at the same rate, which results in increasing prices.

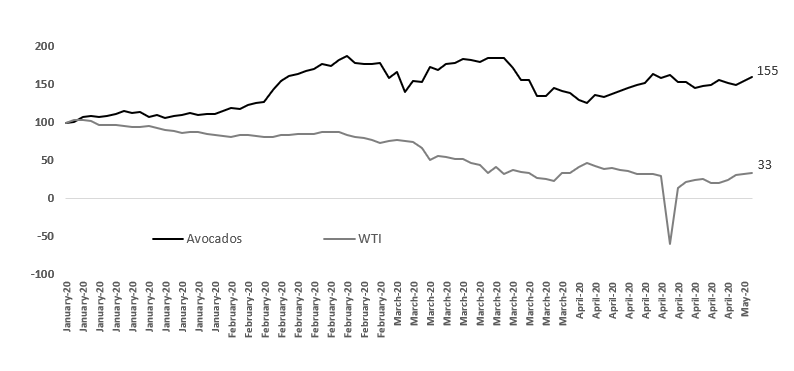

Moreover, in contrast to other commodities, avocado prices and the income from avocado orchards have been resilient during the COVID 19 crisis. The chart below compares WTI spot prices vs. avocado farmgate prices[14].

Avocados vs. WTI during the COVID 19 crisis

In conclusion, avocado orchards provide a true diversification from systematic risks. The naive geographical diversification however is not effective when needed the most i.e. when volatility rises, and correlations increase. Avocados are price inelastic products, consequently they are a stable source of income during recessions.

[1] April’s figure for the global manufacturing PMI (39.8) shows a contraction

[2] April’s jobs report in the US shows the unemployment rate at 14.7%

[3] Delta Air Lines Inc., Ford Motor Co., Macy’s Inc., announced dividend suspensions in the second quarter. US banks, usually big dividend payers are likely to follow the path of British banks and slash dividends.

[4] 12.05.2020

[5] IT (25.7%), HC (15.4%) Consumer Staples (7.4%), Utilities (3.3%) make about 50% of the SP 500 market capitalization and these sectors have been more resilient to the current crisis

[6] Terminal values often make about 60% of the value of a stock when using DCF method to value a company

[7] An increase YTD of $ 2.5 trillion and an additional balance sheet expansion of $ 4.5 trillion based on announced monetary policy interventions

[8] US GDP 2019 $21.428 trillion

[9] As of the 8th May 2020 S&P500 Market Capitalization $24.3 trillion, Willshire 5000 $29.1 trillion, Total Ex Foreign Issues $45.4 trillion and Equities total Issues in the U.S. $54.9 trillion (Yardeni 2020)

[10] Over time the general understanding of real assets has shifted from any inflation hedging asset i.e. assets that tend to increase in nominal value with unexpected inflation (Froot K. 1978) to a narrower definition comprising tangible assets with intrinsic value. (Donohue et al., M.2009; pp.119). Today we understand real assets. as alternative investments such as real estate, infrastructure, and natural resources (Mcvey. H. et al., 2017)

[11] As of December 2019, natural resources assets under management (AUM) surpassed $760bn (Preqin 2020)

[12] As of May 2020, the top 5 largest companies by market capitalization are close to 20% of the S&P500 total market cap

[13] With new technologies it is possible to reach maximal production after 8 to 10 years

[14] Avocado farmgate prices describe the price of export quality avocados if they were purchased directly from a farm in Mexico, without any additional markup

New Orchards for sustainable avocados

It all begins with an idea.

Agriculture is a major source of greenhouse gas emissions, as it releases large quantities of carbon dioxide through the burning of biomass. Some significant changes can be done just by producing fruits and vegetables in places with the right pedoclimatic conditions.

Asymmetrica is leading the way with avocados. The problem with avocados starts when producers cultivate avocados in nonsensical places, i.e. when the irrigation process is not based on rainwater or natural moisture in the soil.

Our orchards are located throughout the state of Mexico. Asymmetrica is looking at productive lands in new states for avocado like Nayarit and Jalisco, which qualify for their sustainable climate characteristics.

The history of investments in agriculture

It all begins with an idea.

For many centuries, the only way to invest in the food industry was through land ownership. Whether for livestock or crops, landowners were the only ones who could invest in this industry, and when they needed to invest in their own land, they had to sell some of it, or borrow against the land. This type of loan was first considered the main type of private agricultural investment in the 19th century in the U.S. When the newly settled immigrants began to expand into the vast territory with merely symbolic prices (less than 20 dollars for 50 Hectares) the main investment became the technology and resources necessary to exploit the land (more than 700 dollars for the same extension of land). It was at this time that the agribusiness profits were transferred to the banks who lent the money for the tools they needed, which in some cases they supplied themselves, and the landowners were left with the sometimes impossible task of repaying these loans. Today this is still the case in many places.

The 20th century witnessed the first global altruistic investment funds. Agriculture was one of the most important industries in which these investments materialized. The funds raised by the United Nations were managed by the FAO.[1] and allocated to many investments in developing countries seeking to achieve food security as their first objective. With the maturation of this industry, private funds from first world countries began to track their profitability and became players in the same movement. They reduced their risk by using mixed investments[2] which became the new standard for agricultural investments in developing countries. These structured investments achieved the objective of introducing private investors into the agricultural industry in developing countries, but did not achieve true independence from the public sector. This generated a duplication of expertise, having on the one hand companies that were expert producers in first world countries and on the other hand experts in dealing with developing countries (governments and population), but they never managed to work in true symbiosis.

It was not until agribusiness enterprises began to grow and become large enough to play a role in financial markets that efficient financial products were made available to them, but even then these products were only for the big players. Today, small producers are still dependent on public resources in many countries to subsist, including the United States and the European Union. Thus, for emerging market producers, the only way to finance their growth, or even their regular operations, is through land-backed loans that, depending on the sponsor, are limited to a fraction of the value of the land, and fall short of the need to grow for economies of scale. This is an inconsistency, as there are many high yielding agricultural products that can give better returns with less risk (most risks can be mitigated or eliminated) than almost any other industry. What explains this situation is that most of these high-yield products reside in countries where financial markets are not yet developed and generally do not have a large enough market to attract large investments other than loans.

How to invest in avocados?

This context is what fertilized Avo Oro Verde, and helped it emerge into what it is now; the premier investment structure for avocado production. We have channeled the need for higher returns in the financial markets into an industry where investments are very difficult to come by, but which generates substantial excess returns when managed intelligently. Our job is to create value for both farmers and investors, and to use the resources invested to make larger, more efficient orchards that generate more returns for both new investors and the original owners. For farmers who want liquidity, we offer them the opportunity to sell part of their land at a good price or to partner with us. For investors we give them the unique opportunity to invest in avocado production without the need to do the exploration and land search work and wait more than 5 years to receive the first returns on their investment.

Avocados, unlike most crops, have a value chain in which producers have the most power. Exporters, distributors, and marketers are many and none have sufficient power to force a price on producers. Therefore, producers can sell their product to the highest bidder taking into account the spot price.[3]. This is the reason why Avo Oro Verde invests mainly in this link of the value chain.

We provide investments with a compelling risk-return profile. The risk of loss is limited by the price of land and avocado trees. Avocados are permanent crops that are more tolerant to extreme weather conditions than cyclical crops. While limited supply and increasing demand for avocados create shortages and drive up prices. The high margins and price spikes of avocados provide a high IRR without the need for leverage in the 20-30% ranges, and since most of the market is in U.S. dollars, the rising dollar price can only help the bottom line returns.

[1] Organización de Comida y Agricultura de las Naciones Unidas (por sus siglas en inglés)

[2] Blended investment (o inversiones mixtas) viene de Blended Finance, que es un término usado para inversiones en que el sector público invierte en proyectos del sector privado y deja que inversionistas privados tengan ventajas a la hora de invertir en ellos, usualmente con menores riesgos y mayores ganancias.

[3] La APEAM tiene una plataforma publica en que los precios del aguacate son publicados dependiendo del precio de Mercado. Estos precios dependen del tamaño del aguacate y el país de destino.